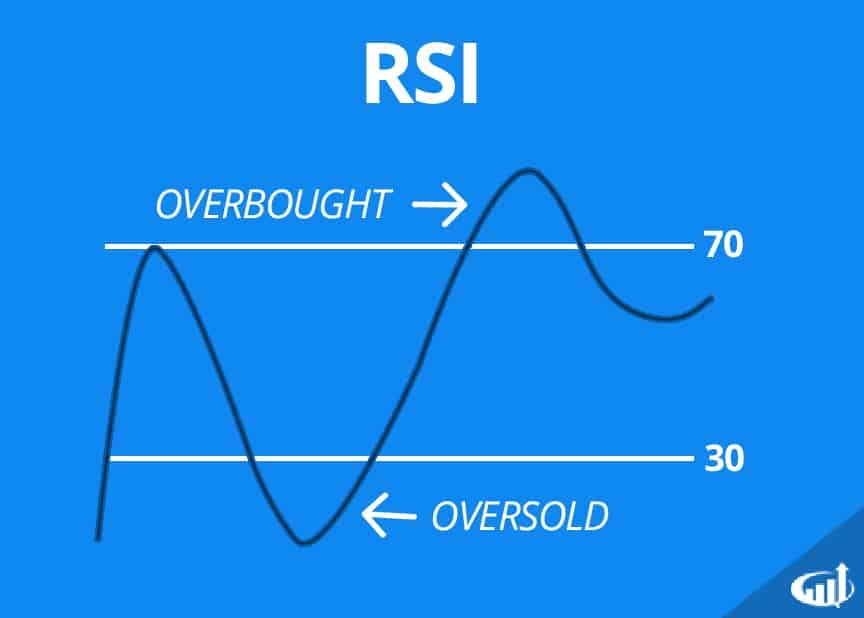

the standard setting of 14 periods generally give the best results and so traders rarely change the settings of the RSI. The relative strength index is a band-indicator: its value can vary between 0.

:max_bytes(150000):strip_icc()/dotdash_final_Relative_Strength_Index_RSI_Jul_2020-02-bcd895603f66447b959a550b1e8855f4.jpg)

the RSI indicator is an oscillator that shows when the market may be overbought or oversold. Most traders do not change the standard setting from 14, as this is the level that gives them the most useful and reliable information. This shows more buyers have moved into the stock causing the buying pressure to be relatively equal to the selling pressure.Reducing the settings can allow you to identify overbought and oversold conditions much earlier, however, this will also result in more false signals. The relative strength index (RSI) is an oscillating indicator that shows when the market may be overbought or. The Relative Strength Index (RSI) saw a jump the past few days and has pushed up to 49 on the indicator. In the middle of the chart is the 50 level.the RSI is calculated it should be placed beneath an assets price chart. The stock may find resistance near either of these moving averages in the future. The Relative Strength Index (RSI) is a momentum oscillator used to gauge the current overbought or oversold condition of a financial instrument on a scale of 0. The Relative Strength Index (RSI) is a momentum indicator that is used to.The stock is trading below both the 50-day moving average (green)& and the 200-day moving average (blue), indicating sentiment has been bearish.The stock could continue to push higher and break out. The stock has been falling and has been getting pinched between narrowing highs and lows.A few months ago the stock was able to break out of one of these patterns and saw a large bullish push. Shares look to be breaking out of what technical traders call a falling wedge pattern.How Does Bitcoin Work? Bit Digital Daily Chart Analysis With Bitcoin bouncing higher Tuesday, the stock is moving in sympathy.īit Digital was up 27% at $9.68 at publication time. Its mining platform operates with the primary intent of accumulating bitcoin which may sell for fiat currency from time to time depending on market conditions.

The company closed its previously announced placement with institutional investors for the sale of 13,490,728 ordinary shares.īit Digital is engaged in the bitcoin mining business. The RSI is displayed in the lower portion of the chart and its scale is the numbers on the right hand side that go from 0 to.

(NASDAQ: BTBT) shares are trading higher Tuesday after the company closed an $80 million private placement.

0 kommentar(er)

0 kommentar(er)